The U.S. Securities and Exchange Commission (SEC) has approved Bitcoin and Ether index exchange-traded funds (ETFs) from Hashdex and Franklin Templeton.

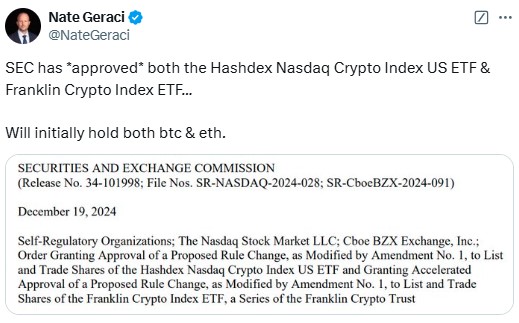

On December 19, the SEC gave the green light to Hashdex’s Nasdaq Crypto Index US ETF, which will be traded on the Nasdaq stock market. Meanwhile, Franklin Templeton’s Crypto Index ETF was approved for the Cboe BZX Exchange.

Both ETFs will hold spot Bitcoin and Ether. The Franklin Crypto Index ETF tracks the Institutional Digital Asset Index, while the Hashdex Crypto Index ETF follows the Nasdaq Crypto US Settlement Price Index.

The SEC’s approval came after both firms updated their filings, with the regulator confirming that the proposed funds met the necessary criteria to protect investors and the public interest.

Nate Geraci, president of The ETF Store, speculated that the SEC’s approval could prompt other firms, like BlackRock, to launch similar crypto ETFs. He believes there will be strong demand for these products, especially as advisers look for diversification in emerging asset classes like crypto.

This approval marks a significant step forward for crypto ETFs in the U.S. Earlier in 2023, firms like Hashdex and Franklin Templeton faced delays in their applications.

Now, with this approval, other firms like NYSE Arca are also looking to list their own Bitcoin and Ether ETFs, suggesting a growing trend in crypto investment products. This move could further fuel the mainstream adoption of cryptocurrencies.

Also Read: SEC Seeks Insights on Bitwise Bitcoin and Ethereum ETF